Sun 17th August 2025 ▪

5

min at reading ▪

Can Ethereum tame the bull? This is a question that has more than an investor. Because behind his recent flight is a very real tilting, but equally fragile. The second market crypto attached performance until he tickled his absolute record. And yet … Despite madness, discreet, but strong signs indicate possible peace. Would the bull be tired?

In short

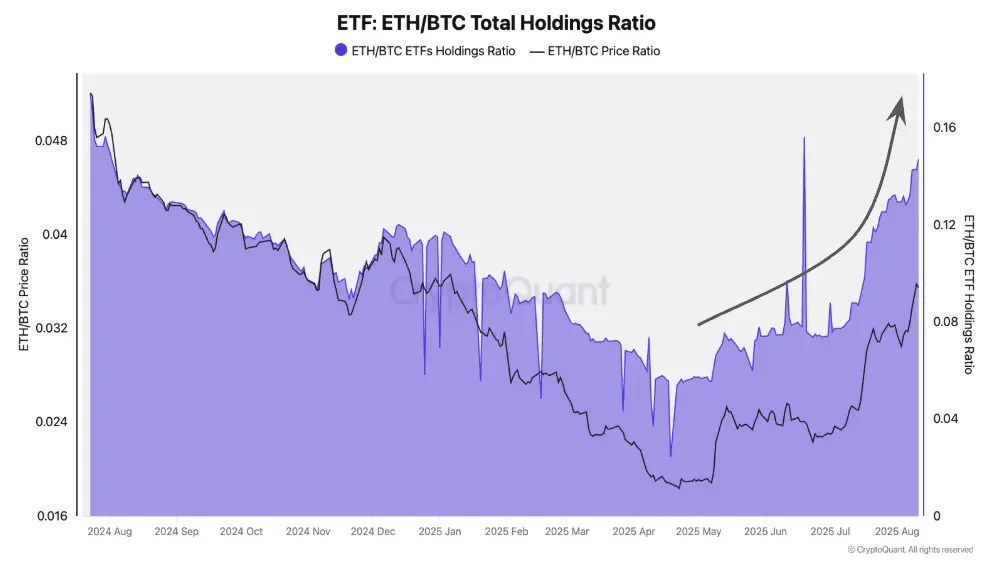

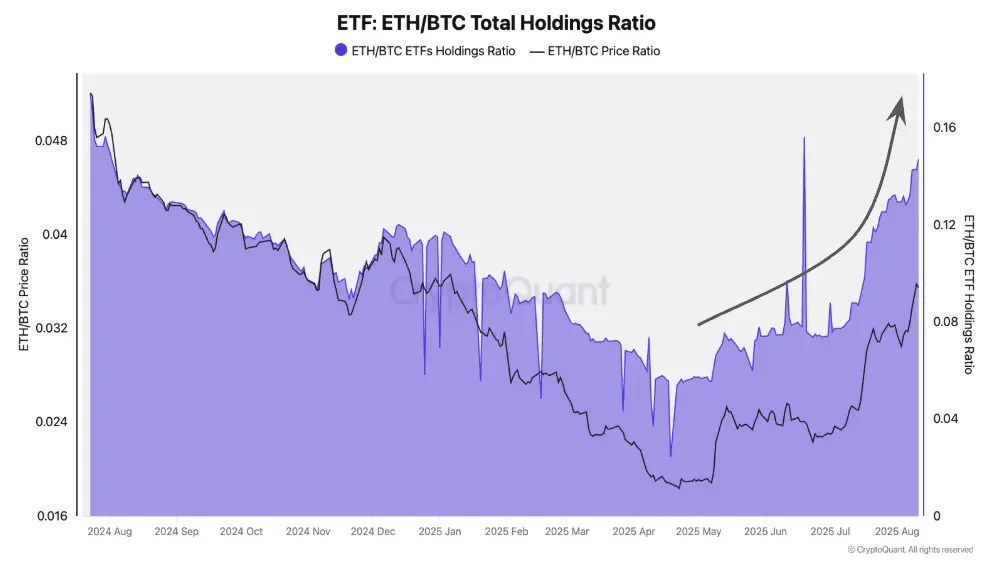

- The Ethereum/Bitcoin ETF ratio increased from 0.05 to 0.15 between May and August.

- Ethereum exceeded Bitcoins in a weekly point volume for four consecutive weeks.

- The ratio of MVRV ETH/BTC reaches 0.8, almost to the threshold signaling historical overvaluation.

- ETH starters on platforms exceed bitcoins, signs of profit.

ETF spends the time of Ethereum: the ratio that explodes

It is an increase in force that is not unnoticed: the ratio of ETH/BTC ETF Crypto has tripled according to the cryptocurrency in three months. Translation: Institutional investors who have still maintained the kindness of bitcoins seem to bet on Ethereum stronger. In August, this ratio increased from 0.05 to 0.15, showing massive transfer of allocation in portfolios.

Another strong clue: Ethereum recently reached $ 4,743, the highest since 2021, bordering on its historical record. At the same time, the ETH/BTC price ratio has exceeded its mobile diameter in 365 days – an indicator that historically announces the power phase for the ether.

Neither trading volumes nor lie: for four weeks, the weekly volume exceeded the BTC volume. According to cryptocurrency, the latest number: 24 billion compared to $ 14 billion.

This increase is explained by the combination of several factors: increased demand via ETF, long -term investors who have decided their positions, and a market feeling that is used to use Ethereum – stakem, defi, tokenization.

Trading, bundles, feeling: Ethereum shows muscles … how long?

Behind exciting characters some signals require caution. According to the cryptocurrency, the appetizers of ETH on the stock market platforms have recently exceeded beginners of bitcoins. This suggests that some holders plan to achieve their profits, especially after such a rapid increase.

Other discrete warnings: MVRV ETH/BTC ratio increased from 0.4 to 0.8 between May and August and approached the threshold of 0.9. In analysts, this level is often synonymous with the relative other overcome – an area where twists are not unusual.

Add to this the renewed activity of ETH permanent term contracts whose open interest grows faster than bitcoins. Interest is there, yes, but the more it rises, the more the risk of domino effect in case of increased benefits.

In short, Ethereum leads dance … but music could slow down. The ETF promotes the climb, but strong hands remain alert in the face of potential consolidation.

Crypto, ETF, Altcoins: Data that speaks for a long time

To better grasp this dynamics in motion, here are some key monuments:

- ETH/BTC ratio ETF: mimost 0.05 to 0.15 between May and August (source: cryptomera);

- ETH/BTC volume ratio: 1.66 – higher level since June 2017;

- MVRV ETH/BTC: around 0.4 to 0.8 – near the area of overvaluation;

- The weekly amount of Spot: ETH ($ 24 billion) exceeds BTC ($ 14 billion), 4 consecutive weeks;

- Open interest ETH: accelerated increase compared to bitcoin.

Ethereum enters the new era. If the market has ever vaccinated, signals are closer: it is a combination of ETF and pension savings of type 401 (K) that could permanently transform this network. It is no longer a simple altcoin, but the central infrastructure of the cryptocurrency tomorrow.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Blockchain and crypto revolution! And the day when the impacts will be felt on the most vulnerable economy of this world, I would say against all the promises that I was there for something

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.